There Is No `Greek' Crisis:

It's the Euro That Has Failed

by Helga Zepp-LaRouche

May 2010

Helga Zepp-LaRouche addresses March 20, 2010 BüSo conference in Bad Salzuflen. |

Helga Zepp-LaRouche is the founder and international chairwoman of the Schiller Institute and of the Civil Rights Solidarity Movement (BüSo), the party of the LaRouche movement in Germany. This leaflet, dated April 30, 2010, is being circulated for the May 9 legislative elections in the state of North Rhine-Westphalia, where the party is fielding a slate of candidates. It was translated from German for EIR.

This article appears in the May 7, 2010 issue of Executive Intelligence Review and is reprinted with permision.Greece and many other countries in the Eurozone and around the world are insolvent. The southern Eurozone countries are EU520 billion in debt to Germany alone, and about the same amount to other countries. Greece alone would need EU135 billion over the next three years. A wildfire is threatening to spread: Spain, whose banks are closely intertwined with those of Great Britain, is a much bigger problem, but also Portugal, Italy, and Ireland will soon require enormous sums of money. The crisis has long since developed into a systemic banking crisis, government bankruptcies, and, in reality, the failure of the euro. But Britain and the U.S. are also insolvent. We are dealing with a breakdown crisis of the system.

The therapy that the international financial institutions are ordering is fatal, and would lead directly to the death of the patient—namely, the world economy. What the IMF, European Central Bank (ECB), European Commission, and financial interests are demanding—on the one hand, endless rescue packages paid for with taxpayer money, and on the other, "draconian austerity measures" for the recipient countries—will lead to hyperinflation, and will plunge the recipient countries into a deep depression. These measures are just as disastrous in their effects as they are hair-raisingly incompetent.

The "tough austerity policy" that is being demanded of Greece means cutting the standard of living by 30% (!) and will destroy more jobs and capacity, not to mention any thought of new productive investment—Chancellor Brüning sends his greetings from the 1930s. The trade unions are talking about the most serious attack on workers' rights since the military junta, and are planning a general strike. As Greece already has hardly any industry, the IMF demand, that it pay off its debts by increasing its exports, is downright absurd. How much more olives and wine will we have then? And if Finance Minister Wolfgang Schäuble says that the bailout would not cost the German taxpayer a thing, because Greece will pay everything back, then his nose must now be so long, that it reaches from Berlin to Athens.

IMF chief Dominque Strauss-Kahn and ECB President Jean-Claude Trichet have used massive pressure to thwart Chancellor Angela Merkel's plans to delay a decision on the question of Greece until after the election in North Rhine-Westphalia on May 9. Now, the Bundestag is expected to approve, on the Friday before the election, a bill on the Greek package. Once the text of the law is known, the four professors Joachim Starbatty, Wilhelm Hankel, Karl-Albrecht Schachtschneider, and Wilhelm Nölling, who previously filed a lawsuit against the euro, will submit a new complaint to the Constitutional Court in Karlsruhe, and request a preliminary injunction. German participation in the rescue package could even pave the way for a return to the D-mark, for in the opinion of some constitutional lawyers, such as former federal judge Paul Kirchhof, German participation in the euro could be called into question if the Monetary Union no longer upholds the principles of monetary stability. In a ruling of October 1993, the Karlsruhe court, in its so-called "Maastricht Judgment," granted any future German government the right to leave the Monetary Union, if the stability of the euro should be exposed as a deception and its value should fall below the standard represented by the D-mark.

As Professor Starbatty stressed in an interview with Neue Solidarität, if Karlsruhe accedes to the complaint of the four professors, a dynamic situation will emerge; whereas if the suit is dismissed, "the Monetary Union slides into a state of instability and inflation..... But may God prevent that from happening."

Hyperinflation Looms

|

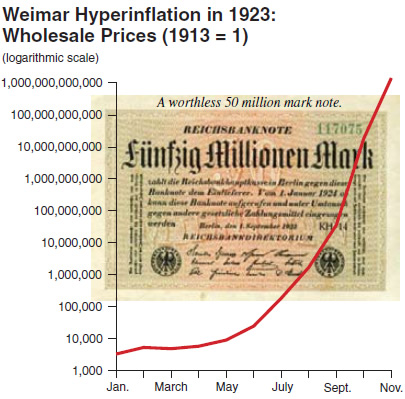

What the IMF, the EU Commission, the ECB, and the OECD really want, is to help the highly indebted states by simply opening up the money spigots. The only problem being that, because of the peculiar nature of globalization, the sums involved will reach mind-boggling heights. The debtor countries' total indebtedness to the banks is around EU1 trillion, and the derivatives tied to that debt are presumed to amount to EU250 trillion. If the money spigots are opened, it might be possible to postpone the collapse in the short term, but the result would be the same hyperinflation as we had in 1923 during the Weimar Republic.

Today, globalization has already been making the rich richer, and the poor poorer; but hyperinflation would be the most brutal form of dispossession, robbing people of their savings and their life's accomplishments. Many Germans can still show you their grandparents' and great-grandparents' Reichsmark banknotes, which made them billionaires, or even trillionaires, but which, in the end, couldn't buy them anything. Even neo-liberal [business executive] Hans Olaf Henkel recently told a talk show that he believes that in the end, we're going to pay with inflation, if we keep thinking we have to remain "good Europeans."

Recognizing that the euro is a faulty construct, does not necessarily mean going against Europe. Far from it: Europe's sovereign states could work together quite well as a Europe of the Fatherlands, in the tradition of Charles de Gaulle, toward a common, worldwide mission. But for that, we don't need a Monetary Union, nor do we need a totally bloated EU bureaucracy which fritters away monstrous sums of tax revenues, and in return for that, destroys entire industrial sectors with its absurd EU guidelines.

The Entire System Is Bankrupt

Given that this crisis has now come to a head, it must be said, clearly and firmly: Any attempt to cling to the Monetary Union and the EU treaties of Maastricht and Lisbon, will plunge Europe into chaos. Even if the parties represented in the Bundestag, acting as obedient executors of the financial oligarchy's orders, think they can rubberstamp the bailout package for Greece (and after that, other states as well), it is nevertheless the case, that back in June 2009, the Federal Constitutional Court in Karlsruhe ruled that the Bundestag's action on the so-called Accompanying Law to the Lisbon Treaty was unconstitutional, and they forced the Bundestag to take a new vote. There is, therefore, a very good chance that this time, too, Karlsruhe will rise to the defense of the Basic Law and currency stability.

It's not just the euro which has failed, but the entire system of globalization, with its "creative innovative financial instruments" and its high-risk speculation which, on a daily basis, is being exposed as criminal rip-offs and frauds. The U.S. Congressional hearings being held by Sen. Carl Levin on Goldman Sachs's machinations, are therefore coming more and more to resemble investigations in the tradition of the 1930s Pecora Commission.

Goldman Sachs is accused not only of having swindled its customers out of billions of dollars by selling them toxic securities, while, at the same time, floating credit default swaps in anticipation of their early collapse—i.e., a double financial killing. Goldman Sachs is also the bank which, for the past decade, has been helping Greece to "pretty up" its budget figures—which is what enabled Greece to enter the Eurozone in the first place. And so, the Bildzeitung daily ought rather to be decrying Goldman Sachs' machinations, instead of poisoning relations between Germany and Greece.

There Is Life After the Euro!

We must, and will put an end to this entire, bottomless swindle! The only question is: Will it all end in an uncontrolled collapse, with chaotic insolvencies, hyperinflation, and a plunge into a new dark age, or, will the program long advocated by the BüSo and its co-thinkers in many nations, such as Democratic Party Congressional candidate Kesha Rogers in the United States, be implemented in time to avert disaster?

What we need is:

- Immediate implementation of a global two-tiered banking system, which will protect those banks responsible for issuing credit to industry, agriculture, and trade, while strictly walling them off from the investment banks. These latter banks will have to put their books into order without state assistance, and, if warranted, declare bankruptcy.

- Everything that has to do with the general welfare, especially wages, pensions, personal savings, social-welfare agencies, and so forth, shall be protected and maintained in the new system.

- All "creative financial instruments" shall be written off. We don't need hedge funds or holding companies, nor do we need derivatives contracts, securitizations, CDOs, CDSs, MBSs, etc.

- Instead of green jobs and investment into completely uneconomical "alternative energies," we need investment into advanced technologies which were developed in Germany, but which are now only being built in Asia. These include the inherently safe, high-temperature nuclear reactor, as well as the Transrapid maglev, the Cargocap system, and manned space flight, which functions as a science-driver for scientific and technological breakthroughs.

- If we recollect our former identity as a people of thinkers, poets, and inventors, our small and medium-sized industry, if supplied with sufficient credit, can not only re-establish full productive employment, and a flourishing domestic market with a high standard of living, but we can also then participate in great infrastructure and scientific projects in Russia, China, India, and hopefully also in the United States, as part of an effort to reconstruct the entire world's economy.

The good news is that there is life after the euro! But it's up to us to decide how that life will take shape.

On May 9, vote for the BüSo, the only party which, from the very outset, forecast that the fatally flawed character of the euro, and the collapse of the global financial system, and the only party which, along with its allies in the United States, Russia, China, India, France, and Italy, has a concept for overcoming the global financial crisis, a concept which is in keeping with the idea of a new credit-based system.

This time, don't vote for the "lesser evil"—any evil is already too much—and also don't join the non-voters' party. Vote for the party which has a real vision for the future: BüSo!

Related pages:

2007 Eurasian Landbridge Conference

Articles by Helga Zepp LaRouche

LaRouche Show: Goldman Sachs Is Coming Down: Now's the Time for Global Glass-Steagall!

LaRouche Show: The Coming of the Ides of March: LaRouche Democrat Wins in Texas!

EU Opens the Floodgates For Hyperinflation

A Glass-Steagall for Europe: Outlaw Currency Speculation

CargoCap: A New Way To Transport Freight

Lisbon Treaty Ratification: A Day of Shame for The German Parliament!