U.S.-China Cooperation on the Belt and Road Initiative

and Corresponding Ideas in Chinese and Western Philosophy

April 13-14, 2017

New York City

The Value of Infrastructure

by

Jason Ross

Transcript:

The Value of Infrastructure

A PDF version of this transcript appears in the May 5, 2017 issue of Executive Intelligence Review and is re-published here with permission.

Dennis Speed: I want to welcome you on behalf of the Schiller Institute to Panel II of our conference—“U.S.-China Cooperation on the Belt and Road Initiative, and the Corresponding Ideas in Chinese and Western Philosophy.” The first speaker for this afternoon’s panel is Jason Ross, editor-in-chief of 21st Century Science and Technology and co-author of “The New Silk Road Becomes the World Land-Bridge.”

Jason Ross |

Jason Ross: It’s very good to be here; I’m glad to see so many people in the audience. I think that we’ve heard really tremendous presentations this morning on what the Belt and Road Initiative can mean for the world, what the World Land-Bridge can mean as a new standard of relations among nations and as a new basis for economics. I think one of the things we heard was that geopolitics is being replaced by the Belt and Road Initiative—a new way of relating among nations. Geopolitics—the British Empire—this explains why, for example, the United States did not join the Asian Infrastructure Investment Bank. It does not explain, by itself, why the United States let its infrastructure completely decay. So for that, I want to take a look at what new thoughts about economics are required by the Belt and Road Initiative.

If we look overall at the value of infrastructure—that’s what I want to focus on today, because there are aspects of infrastructure that make it different from anything else in the economy. Wrong economic thinking about it prevents financing and prevents it from being built, and holds us back from reaping all of the benefits that we could from investments in these sorts of projects. If we look at the human species as a whole, what characterizes us is that over historical time, we have become a new species—repeatedly. If we were looked at from the standpoint of biology, you would say that the human species has been supplanted and transformed into a new species, a new genus, a new family, many times in our history. We’ve seen this in the changing relationship that we have to our environment. We’ve seen it in the changing number of people that can exist on the planet.

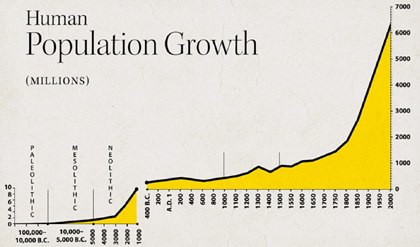

Figure 1

View full size |

Figure 2

Life Expectancy

View full size |

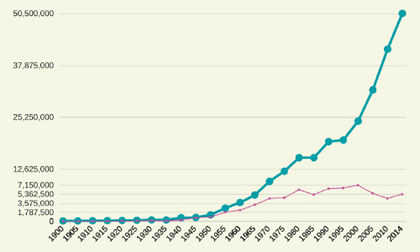

This [Fig. 1] is a chart of human population over the past 10,000 years. No animal species willfully changes the number of its species that can live on the planet; we do that. How do we do that? We do that in what makes us human, which if we look back to the Greek creation story of the human species, to the story of Prometheus, we’re told a tale of how the human species was created. This tale asserts that before Prometheus, we had bodies that were human, but we didn’t have minds; we didn’t use fire. Prometheus, in giving fire to mankind, and number, and poetry, and astronomy, and the calendar, and all of the arts, and metallurgy, and medicine, and sailing ships, and the use of animals—by giving knowledge to mankind, we became a new species on this planet. That’s the basis of our transformation in our living standards. Here [Fig. 2] you see a chart of life expectancies over time. The red line is life expectancy for different nations in 1800; where you can see that even the nation with the highest life expectancy, Belgium, their life expectancy was only 40 years in 1800. Think what the average age of a person in a society like that would be. How advanced could such a society become, if this is the maximum age people are reaching? You see a tremendous increase. You see what had been reached by 1950, and now today—2012 and beyond—every nation in the world has a life expectancy that’s greater than that of Belgium, which had the highest 200 years ago. That’s something to be very happy about and proud of, and reflects something that’s absolutely different about our species from any other sort of life.

What is ‘Infrastructure?’

Figure 3

|

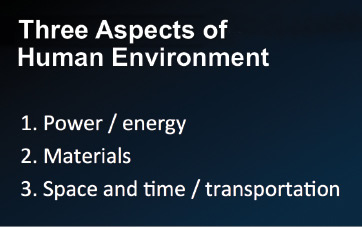

Figure 4

View full size |

So, what is infrastructure? Think about the word “environment” for a moment. We use it in many contexts. Sometimes we mean specifically things like the air and the water around us; sometimes it has a more general meaning, like the ambience. What’s the environment in a social situation? What’s the environment like in a restaurant, for example? But our environment—the world around us—is increasingly one that we create. The resources that we use—unlike animals—are not ones that we find around us. An animal looks for plants to eat; a plant hopes some sunshine will land on it. These are just things that are around it; it doesn’t create them, it uses them. For us, this synthetic environment that we create for ourselves, is our infrastructure. By mediating our discoveries that we have made, the science that we know, the technology that we’re capable of—by implementing them as a platform of infrastructure, we set ourselves up for a certain level of civilization, of economic potential.

Very quickly, I’m going to run through three ways that this happens [Fig. 3]: in power, in materials, and in space and time. If we look at a chart of power use [Fig. 4] in the United States per capita over the history of our nation, we see both that power use overall has increased per person, and that the source of that power has changed from wood, to coal, then increasingly to oil, and natural gas. Fission never really made it off the ground. So, we have produced more power and of a different kind. We can do something with oil that we can’t do with wood. You are never going to build a car that operates on wood chips—impossible. You can have a car that operates on oil. You’re not going to have an airplane where someone is shovelling charcoal into a burner on it—never will happen; it’s something we can do with oil. Then think about what we can do with electricity—more on that in a moment.

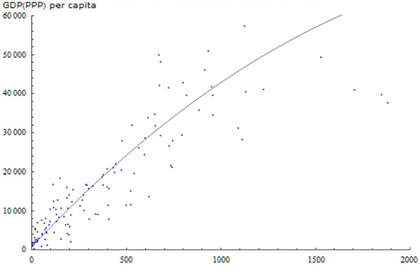

Figure 5

Electricity Consumption vs. GDP, per capita

View full size |

Figure 6

World Lighted at Night

View full size |

Take a look at this chart [Fig. 5]. On the x axis, we have electricity used per capita—this is for all nations in the world; compared to per capita GDP. You can’t have a high standard of living, even as measured in GDP—which is imperfect—without electricity. Energy or power is required for a high standard of living. What sources will be able to provide five times the world’s current power use? For the world as a whole, per capita, to use as much energy as a person in the United States per capita, we need five times as much energy. What will provide five times the current total energy on the planet? What power source is capable of doing that? Here [Fig. 6] you can see the uneven development currently, as exhibited in this very clear marker of power—light at night.

One other thing on that: In terms of the way we use power—take for example uranium. Now uranium used in a nuclear power plant has a tremendous amount of power in a very tiny amount of fuel. Uranium could be burned; you could burn uranium if you wanted to. So, you could take uranium and put it in a coal power plant; you could throw it in and burn the uranium; boil water, create steam and run a turbine. Does anybody have any idea how much less power you get from uranium if you treat it as a chemical, compared to a nuclear fuel? About 100,000 times is the difference. There’s a limit for all chemical fuels. The power in the electric bonds that combine the atoms in a molecule, the power that’s just potential in that kind of physical relationship is less than that in the nucleus by a factor of 100,000. Tremendous difference.

Think about the materials that we use. The materials that we use on a regular basis have changed throughout human civilization as well. Things that we take for granted or use on a daily basis—like aluminum—are possible only in an economy that has electricity. Without electricity, aluminum is very hard to produce; and bauxite is really not a resource, it’s not commercially viable to produce aluminum from it without electricity. The plastics that we use—this is the other big use of oil. Besides airplanes, which I can’t imagine running on a battery, the other necessary use of petroleum is plastics. But if you look at our relationship to material after material, to steel, to iron, to our production of nitrogen. . . . Artificial nitrogen fertilizer, is a technology which by itself has increased the potential population of the planet by 25%-30%. Our environment is one that we create; and the resources that are around us are ones that we create. We create a resource. Discovering how to turn a rock into a metal; we have just now created a resource where one did not exist before.

The Man-Created Environment

Figure 7

World Production of Rare Earths (tons)

View full size.jpg) |

Figure 8

World Production of Chromium (tons)

View full size.jpg) |

|

Figure 9

World Production of Fixed Nitrogen (tons)

View full size.jpg) |

Figure 10

World Production of Aluminum (tons)

View full size |

Figure 10

World Production of Steel (tons)

View full size.jpg) |

If you look at the change in how these are used—the amount of steel that we use, the amount of coal that we use; the production of rare earth elements. People say that the use of resources like oil has fueled much of the conflict in the world, because of people trying to control the use of this precious resource. But what about rare earths? [Fig. 7] These weren’t even considered a resource 50 years ago; now they’re a very major one. We made it so. Similarly chromium, nitrogen, aluminum, and steel [Figs. 8, 9, 10].

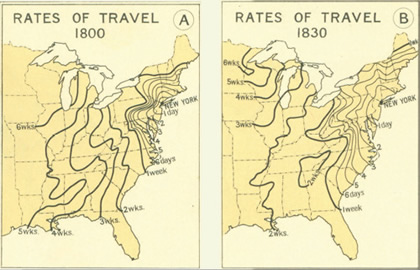

Figure 11

View full size |

Figure 13

View full size.jpg) |

We also transform our physical environment in the sense of the space that’s available to us economically [Fig. 11]. Look at the distance that you could travel from New York over a certain period of time in 1800, where this line represents the limit of two weeks’ travelling from New York. By 1830, this is the line of the extent of two weeks’ travel from New York. It wasn’t because faster cars were produced; it’s because we transformed and created a synthetic environment for ourselves. We built canals; we built roads. We transformed our environment. By 1857 [Fig. 12], two weeks gets you all the way out here; we have rail lines by this time, in the eastern part of the United States. And by 1930 [Fig. 13], you could reach anywhere in the country in less than half a week.

So, if we try to understand as economists, the value of this type of infrastructure, we really miss the point if we only look at a business-by-business standpoint and try to estimate how much a certain business will benefit from reduced freight costs, or reduced shipping times. What we have to take into account is that an entirely new type of economic production is now possible. Now you can produce intermediate goods and ship them elsewhere. That kind of connectivity in industry is possible. It gives us the ability to move resources around, and to site production in different locations. You’ve transformed how useful land is, in all the areas along which this development corridor extends. So, those are three ways that we’ve transformed and created an environment which we can call infrastructure.

Figure 14

|

For the future [Fig. 14], I think the three big things are: 1) The development of fusion power, which will transform our relationship to nature in a way that’s like the development of the steam engine, in terms of how huge the difference will be. Then we will be able to produce great quantities of power. And this gets to the second point—we could desalinate ocean water, to have a better control over our water systems on the planet, and totally transform our relationship to materials. With fusion, we would no longer need coal to produce metals, as we do today, since we are forced to use chemical processes.

I’d like to now discuss three problems that economists have in understanding the value of infrastructure, and then lay out four techniques for successful economic policy. The first problem with the value of infrastructure and science, is that the payback is not commensurable with the expense. To a monetarist—the way that economics is generally taught now—if you spend money and you make money, the return is some percentage of the cost. If you gamble on e-trade and you make money, you spent money and you made money. It’s like playing poker or anything else.

That’s not the case when you’re investing in a new platform of infrastructure. If you build out electricity lines across a nation, and now all of the economy can benefit from the use of electrical production—the payback is not a multiple of the cost. You have an incommensurable economy as a whole. How do you measure the value of that? Not purely in dollars, that approach misses it. How about in potential lifespan? How about in potential population? Much better measures.

The second problem is that the value of an infrastructure platform or a scientific discovery cannot be localized, or expressed as the sum of localized bits of value added. That transcontinental railroad system as a whole had a value that can’t be localized. The discovery of a scientific principle—Lise Meitner’s hypothesis that uranium was not decaying, but was actually fissioning, or breaking up into large pieces. That idea of hers—which was right—is the basis of fission power. That one idea transforms the entire human species instantly. As a whole, we are a different species based on an idea created by one person—not localizable, right?

Limitations on Private Financing

The third problem with infrastructure when economists try to account for it, is that the return is indirect. If you build a dam and prevent flooding, you don’t make money directly from having done that, but clearly, it has a value. Something that Rafael Correa pointed out in Ecuador recently, with the massive flooding that had caused a great deal of devastation in Peru and Colombia—but Ecuador got by reasonably well, because they had invested in water-management infrastructure.

Correa said, “Bankers make the mistake of looking for a return. That’s fine sometimes for a private venture, but it’s not right for the state as a whole.” So if you think about things like public roadways, local roadways—these are things that don’t create a direct return in the way that building an airport terminal would. While a public-private partnership might indeed invest the money in partially rebuilding La Guardia airport, you’re not going to get a PPP to take on a huge project like building up a transportation network to the Bering Strait. The return is too long-term and indirect. Therefore, it’s a problem to think that you have to be able to attract private finance. We need mechanisms that are appropriate for the nation, and those mechanisms are different than what a private enterprise would do.

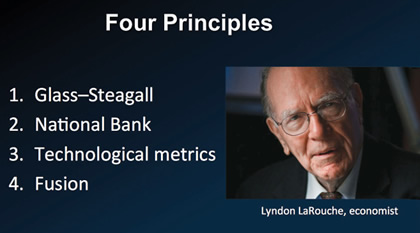

Figure 15

|

So, let’s take a look at these four mechanisms, these four principles [Fig. 15] in order to make all this a reality. Lyndon LaRouche, the economist, put forward four principles to make a recovery possible. The first one is Glass-Steagall. Many economists think that the way you create demand or growth in an economy if it’s sluggish, is that you lower interest rates and just make more money available. Trillions of dollars in loans and loan guarantees have been made available to Wall Street; and that money, those loans, are just sitting in the Federal Reserve. They don’t go anywhere; they never leave the banking sector. Currently in the United States, a great deal more of our GDP is attributed to finance than to manufacturing, for example. Therefore, money is just staying in the financial sector. With Glass-Steagall, we can force banks to get back into lending again. Investment banks can do what they want; but the only way a commercial bank is going to make any profit is by lending—which is what banks are supposed to do.

As a matter of fact, we need a national bank, in order to take advantage of opportunities for building infrastructure that doesn’t create a direct return. We need a mechanism where an indirect payback is suitable for capturing the value created by building a new infrastructure platform. something that a national bank will allow us to do. As we direct credit to enterprises and ventures and infrastructure platforms, the metric is not a monetary one; it’s a technological one. Are we increasing the energy flux density of the economy as a whole? Are we improving the amount of power available per capita? Are we improving the quality of power available per capita?

View full size

China’s first lunar rover, Yutu (Jade Rabbit). |

View full size

LLNL

Laser fusion research at the National Ignition Facility at Lawrence Livermore Laboratory. |

Think about the need to expand our control over space, for example. You can build as many windmills as you want all over the planet, but they will not get a rocket off the ground. Developing nuclear rockets gives us a whole new potential to redirect an asteroid coming our way, to therefore have a greater control over space, etc. So the metric is not monetary, it’s technological. Last, we need a crash program to develop fusion power as the next platform of power as a whole for the human species. With this, we have the ability to control materials, to control water, to control power, to create artificial fuels—we can create methanol, for example, instead of gasoline. We can save our petroleum for use in plastics where it’s irreplaceable. Instead of burning it, we can use it to make things. We no longer cut down trees on a mass scale for power; we save our wood for furniture—which you’re not going to build out of coal.

So, I would just say that we should remove any problems—“inhibitions” isn’t the right word. There’s a lot of very wrong economic thinking that we need to throw aside. The whole monetarist idea of economics, for instance—that everything can be understood in terms of individual bits of profit that are added up, as opposed to looking at a platform that provides an incommensurable value to what came before. That kind of economic thinking has to be rejected, because if we stick with it, we will never be able to finance the kinds of projects that we need in the United States. If Trump says we need $1 trillion, the American Society of Civil Engineers says we need $4 trillion, if Chinese experts say $8 trillion, if an engineer at a conference I was at on Friday says $10 trillion, where is all of that going to come from?

It’s not clearly going to come from purely attracting private investments. We need mechanisms that reflect the real value, the indirect value and the incommensurable value of infrastructure as a platform on which the entire economy rests. We need to invest dramatically in the scientific breakthroughs that will make that next level of platform possible; such as primarily research on fusion power. Thank you.