The Future of the Euro

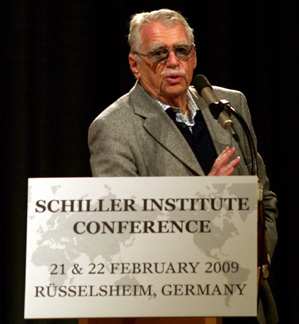

Prof. Wilhelm Hankel

February 2009

| Professor Hankel, former head of the Money and Credit Department of the German Finance Ministry under Karl Schiller, and former chief economist of the Kreditanstalt für Wiederaufbau (Reconstruction Finance Agency), gave this speech to the Schiller Institute’s conference in Rüsselsheim, Germany on Feb. 21. It has been translated from German |

When the euro was introduced as Europe’s common currency, one of the most eminent European economists wrote, “Now there will be no more economic crises in Europe. That is just for the Third and the Fourth World.” Ladies and gentlemen, we have arrived into the Third and Fourth World.

The financial crisis that is the central theme of your conference, and that has just begun and is by no means over, did not begin in Europe, nor with the euro. But unfortunately, the euro will now hamper Europeans’ efforts to re-emerge from this crisis unscathed. The euro is not a tool for crisis prevention, but on the contrary, it is a crisis amplifier. That is what I want to establish.

EIRNS/Julien Lemaître EIRNS/Julien LemaîtreProf. Wilhelm Hankel at the February Schiller Institute Rüsselsheim conference. |

When the euro was introduced, the hard-currency countries, with Germany at the top, the so-called D-mark bloc, gave their European friends a generous interest-rate gift. In the countries that I will call the “Club Med countries” for short, since most of them are on the Mediterranean—Spain, Italy, Greece, and Ireland as an “honorary member”—interest rates were reduced to one-half to one-third of their previous levels. Spain had interest rates of 18%, Italy 14%. With the introduction of the euro, they all went down to the German level, which at that time was 6-7%.

This interest-rate gift was necessary, since these countries did not fulfill one of the most important criteria for monetary union, namely the convergence of economic development and economic policy. Overnight, a boom was unleashed in the Club Med countries, which then developed into a bubble—inflation of credit based on low interest rates. This was made possible by the “secure creditworthiness” of the old, more stable countries, as the weaker euro of the Club Med suddenly became equal to the stronger euro of the old DM bloc. A Spanish, Irish, Italian, or Greek euro had the same value, and the same guarantee of stability in all respects, as the German, Dutch, or Austrian euro. The European Central Bank was the guarantor of our synthetic “euro stability.” It exchanged, and continues to exchange, all these euros of such divergent value, at the same common rate of 1:1.

To this very day, I have not found out whether the fathers of the euro had any premonition of the crisis we are faced with now. If you look inside your wallet and take out an x-denominated euro bill, you’ll find a letter in front of the number designating the value of the bill. The letter X stands for Germany, the letter U for Spain, etc. You can still see today, on every euro, which central bank issued and printed it. And although the exchange rate remains 1:1 for these various euros, that does not exclude—I’ll come back to this later—the introduction of something like a new, differentiated exchange-rate policy in Europe.

But first, the introduction of the 1:1 euro in 11 countries—now there are 16—led to divergence of economic development and, even worse, of inflation rates. The OECD recently reported that the inflation lead of the Club Med countries—those I have just named—has been 20-30% by comparison with the Center, since the euro’s introduction.

This is bad enough in itself, and justifies the lawsuit that Mrs. LaRouche mentioned earlier, which I filed ten years ago before the Federal Constitutional Court (Bundesverfassungsgericht), along with three colleagues. We had sued, based on a ruling by the same court in 1993. At that time, the highest German court established succinctly, as the ruling states: “Should the euro prove not to be as stable as the D-mark, any German government could”—and I add, would have to—“leave the Monetary Union.”

In our suit, we had argued that 11 countries (much less the 16 we have today) could never achieve or maintain the stability of the D-mark according to the philosophy of “one size fits all.” The court then told us that a German Constitutional Court’s mandate does not include verifying the accuracy of economic theories. Meanwhile, it’s obvious: It’s happened!

Hand in hand with the disparity in inflation, however, went something whose dramatic character we had underestimated back then, namely the massive private foreign indebtedness of the Club Med countries. Investments in Greece, which is today one of the most unstable countries; investments in Ireland, which is also unstable today; not to mention Spain, Portugal, Italy, and others, had the same currency guarantee, the same protection for creditors, as investments in stable countries. The result was, and is, massive foreign indebtedness of all the former soft-currency countries. Whether it’s Ireland, Portugal, Spain, Italy, or Greece—not to mention the newly arrived “great states” such as Malta or Southern Cyprus—they are now all up to their necks in foreign debt. I am not talking about state debts, but private debts.

And now, in this financial crisis, we are experiencing how these funds are draining away. They are draining away from Ireland; they are draining away from Greece, they are draining away from all these countries. And so the specter is emerging, not only in Ireland but in the entire group: bankruptcy of the banks, plus state bankruptcy.

‘No Bailout Clause’ Is Irrelevant

The EU treaty which is the basis for the euro, however, includes Paragraph 103, which provides for precisely this situation, but which, in the present crisis, appears to have been pushed aside—the so-called “no bailout clause”: Each state is responsible for its own finances, and no state has a legitimate claim on others to bail it out. And now it appears that in the current crisis the “no bailout clause” is suddenly no longer valid. For the threat of bankruptcy of the state and the banks in perhaps 10 or 11 of the 16 countries is naturally not without its effect on the Monetary Union, the euro, and the cohesion of the EU.

Hence the desperate efforts by the European institutions, the Commission, and also the ECB, to organize something like a European assistance program, a stand-by system. But the question is: Where is the money to come from? And the even bigger question is, what amounts are we talking about, and who is going to cough them up? Because meanwhile it becomes clearer every day: The four surplus countries of the European Union, namely Germany, the Netherlands, Austria, and to a lesser extent Finland, are absolutely not in the situation they once were, to use their surpluses to balance out the deficits of the other groups. Thus, even in the past, the “no bailout clause” was irrelevant, since the surplus countries had been using their surpluses to finance the flows of funds into the deficit countries—a flow that consisted, and and still consists, of euros, but also of foreign currencies such as the U.S. dollar.

But this role of the former D-mark bloc as “banker” has been played out. Every day it’s getting clearer: The surpluses are shrinking—in the German case, downright catastrophically, but the same in the other cases—yet the deficits of the less stable countries are rising even more catastrophically, since underconsumption and overinvestment in the Club Med countries are now leading to massive capital flight by foreign creditors.

The whole thing is an ironic arabesque: This capital flight is weakening the euro and is strengthening the dollar, and thereby the heartland of the crisis. It is certainly a safer haven than the euro. And because of this, since a few weeks ago, you have been seeing the euro going down and the dollar rising, even though the dollar really ought to be going down, too. But that’s only secondary.

The question now being posed in Europe is of existential significance: Could the four surplus countries of the former D-mark bloc, like Atlas, support the weight of the rest of inflation- and deficit-ridden Europe? Would that not overextend them?

They don’t seem to think so in Brussels, since the French initiative there amounts to setting up an economic government and floating common EU bonds. Such an economic government would do only one thing: establish quotas for the stand-by credits required.

And one doesn’t have to be an economist to forecast that the four surplus countries are not in any condition to supply the sums required for such a common bond. For their deficits are reaching astronomical sums, and they will only increase because of the deficits of the countries that are EU members but are not yet participating in the euro, but are standing outside the door: the so-called Exchange-Rate Mechanism No. 2—e.g., the eastern Europeans, the Baltic states, Poland, Hungary, the Balkan states, etc. And the surpluses of the four creditor countries are taking a dramatic nosedive.

Europe is sinking into an orgy of threatened illiquidity of the banking system as well as of state financing, and the “banker” countries that could previously pay for it, are meanwhile seeing the same problems at home. Neither the German savings rate nor German tax revenues are remotely adequate to meet domestic obligations, much less those additional burdens that are now being demanded that Germany take on for others. European solidarity is collapsing from its costs!

We are already experiencing what will become even more intense in the coming months: The current account surpluses of the one group are going down, and the current account deficits of the other are rising. The total deficit of the Eurozone is increasing. With respect to countries outside the EU, that means a decline in the exchange rate, devaluation of the euro, intensification of capital flight. Domestically, the crisis of the real economy will intensify, economic growth will turn negative, the crisis will smash into the labor market. Europe as a whole is threatened by mass unemployment.

The European institutions, particularly the Commission and the European Central Bank, but also EuroStat, the statistical office of the European Commission, have spared no effort to cover up the long-looming crisis. To this day, the European Central Bank has refused to reveal the bilateral current account deficits of its members. All we know is the total deficit of the Eurozone. The same goes for EuroStat. Years ago, I sent a member from your ranks to EuroStat. He came back and reported: Bilateral figures for the foreign economic performance of the individual national economies within the Eurozone are not publicized. That means that the public, and presumably also national policymakers, have been left in the dark about the slow maturation of European-wide inability to pay!

But whether that is now reflected in the statistics or not, the situation is unfortunately what it is. From one day to the next, there are increasing signs that more and more EU countries, as well as those waiting outside the “Euro Door” with a claim to be allowed in—Latvia, Ukraine, Poland—as well as those within the Eurozone—Ireland, Greece, Spain, Italy—are getting closer and closer to the brink of bankruptcy of the banks and the state. There is no rational concept of assistance. “Continue to do what we’ve been doing,” is the slogan. But that is tantamount to a political declaration of bankruptcy.

What is happening here is also a damning indictment of economic science. There is now a strong movement here that insists that currency exchange rates should be replaced by a currency region. Robert Mundell’s “optimal currency region” maintains that currency rates are superfluous. The man even got a Nobel Prize in Economics for this false doctrine, and is presumably still enjoying his prize money, though I’m sure he’s no longer enjoying the reasons why he got the prize.

Reestablishment of National Sovereignty over Currency

If we try to treat the problem rationally, it turns out that there is only one way out of the Euro-crisis: reestablishment of national sovereignty over currency. It’s not for nothing that state and currency have formed a pair for 3,000 years. And the notion that an NGO—namely, the European Central Bank, a stateless central bank—could be entrusted with management of 16 currencies, surely is among the more insane ideas of our time.

We need a return of exchange rates, living, breathing exchange rates, a system of national currencies with their own regulation of the quantity of money in circulation, control over credit, and inflation risk-free interest rates. And why? Because this is the prerequisite for defending ourselves against the looming threat of state bankruptcy. Only a central bank can do that, ensuring the financial sovereignty of the state, economy, and society—possibly at the cost of later inflation. But often the prospect of later inflation—in the current crisis it is not occurring anyway—is less terrifying than unpaid wages, salaries, and pensions, and massive loss of jobs.

We must return to realistic exchange rates, and that means a complete revision of the current monetary system: a new Bretton Woods. And that, in turn, means the complete revision of the Eurozone, this subsystem which is so crucial for the stability of global financial affairs. The separation of the state from utterance of currency, and the resulting worldwide privatization of credit: These are the two fatal errors of the today’s Zeitgeist which have plunged us into this crisis. The sooner political leaders both on this and the other side of the Atlantic realize this and correct their error, the sooner the Western world will emerge from this crisis, and at lesser cost!

If that does not occur, it won’t be long before we see the Eurozone completely falling apart, either through cessation of payments or through outright quitting—since every state must put its own concerns first. I might add that this will be a healthy shakeout of the Eurozone, since it will be reduced back to the old D-mark bloc. Because only the D-mark could successfully be a common currency: Even early on, exchange rates in this area were structurally stable because of the intensive integration of economic activity and trade. And if you have “real,” stable exchange rates, then you can also legalize this state of affairs, by means of a common currency. But if you have rates which are overvalued in real terms, such as you have in the “Club Med” countries, which in turn bring depressed interest rates at high rates of inflation, then sooner or later you are going to punish the market. And that’s exactly what is happening right now!

And thus, either the Eurozone will shrink back into an expanded D-mark zone—which, however, Germany’s numerous “friends” in Europe don’t want. And presumably they know how to prevent it. Therefore, on this issue we should have people come up with a compromise between “as much monetary autonomy as is necessary, and as much European cooperation as is possible.” It could be with a restructuring of the Eurozone. That could be brought about by having the national central banks issue their own currency, or their own euros with the corresponding letters in front of the denomination; and then among the various national euros you could bring about a system of realistic exchange rates.

The European Central Bank would then play the role of a European International Monetary Fund, a coordination bureau, and the old euro could continue to exist as a unit of account, similar to the ecu or the IMF’s Special Drawing Rights. No longer as circulating money, but rather as an abstract unit of account and reference basis for exchange rates.

Why is this solution—the reverse phasing-out of the Eurozone—ultimately inevitable? First of all, because the states’ political and democratic responsibility toward their citizens, their well-being and their social stability, cannot be shouldered by any NGO or supranational institution. Only recently, a friend and fellow combatant appeared before the German Constitutional Court in regard to the Lisbon Treaty, and told the justices that a supranational organization such as the EU is not a state. And if it is not a state, then it can possess neither the responsibility, nor the instruments that are now required to get a crisis in hand here at home and in the other European states.

There is therefore no pathway which circumvents a return to national monetary sovereignty, since an active structural and economic policy must always stand on two legs: monetary policy and state financial or fiscal policy.

The gap between monetary policy, which has become supranational, and fiscal policy, which has remained national, must be closed once again. Because only then will there be justified grounds for hope that Europe’s states—the 16 inside the Eurozone, and the other 11 on the threshold—can, through a great exertion of national effort, once again be freed from the stranglehold of this seemingly bottomless crisis.

That’s no utopia. In 2000, I was active as a government and central bank advisor in the now-vibrant Asiatic “tiger” countries—in China, Indonesia, Malaysia, Vietnam, and others. These countries also had to learn back then, that with incorrect exchange rates they would slide ever more deeply into crisis, ever more deeply into foreign indebtedness, since an incorrect exchange rate leads to the seductive illusion that foreign capital is cheaper than domestic capital. But when the foreign capital starts flowing out again, you see how expensive it actually is.

These countries devalued their currencies by between 20% and 30%, and are now completely stable. Since then their economies have been vibrant.

My proposal is both theoretically compelling and empirically tested, and now it will all depend on whether what I’m presenting here becomes the focus of future policymaking. Then we can indeed hope that with a timely reorganization of the Eurozone, and with the aid of national exertions, we can be rid of the worst consequences and costs of the present crisis.

But as for what will happen if this is not done, I dare not elaborate. Because then this crisis will have even more terrible consequences here than it will in America. For one of the biggest differences between this side of the Atlantic and the other, is that the new U.S. President Barack Obama has the power to wield both instruments of crisis elimination: monetary policy and fiscal policy.

And he needs both. You only have to get a clear sense of the dimensions we’re talking about: America’s fiscal program is in the magnitude of $700 billion. That’s almost the same amount that Germany is spending: Eur500 billion. I.e., the fiscal burden on each U.S. citizen—public debt and then tax hikes—is only one-fourth as great as in Germany. How can they do that over there? Because the chief burden of credit supply for banks and the economy lies not with the State, but rather with the Federal Reserve System. You can debate whether it makes sense for a central bank to buy up junk loans and release them. But the question right now is how to stop the crisis from overflowing and spreading into the real economy, into what Mr. LaRouche calls the physical economy. What’s done later on, is another thing entirely. America is, in any case, further along in halting the crisis, than Europe.

That is one more reason why reasonable speculators have long come to understand that the dollar holds better cards than the euro. The euro is a fiat currency, and the dollar is not. The task at hand on the old continent is, therefore, how to minimize the damage to the real economy resulting from the failed euro experiment, and to keep that damage as small as possible. That would already be a significant victory.

This, ladies and gentlemen, concludes my analysis. I have sketched out what a future European monetary system should look like. It is and remains, of course, a subsystem of the world economy, albeit an important one. As to what a future world monetary system will look like, I leave that up to the initiators of this conference to sketch out. But my own views do not diverge all that much from theirs.

Thank you.