Highlights | Calendar | Music | Books | Concerts | Links | Education | Health

What's New | LaRouche | Spanish Pages | Poetry | Maps

Dialogue of Cultures

LaRouche Replies to Emails

Summer-Autumn

2002

On the Financial Bubble

AUTUMN, 2002

To: schiller@schillerinstitute.org

Subject: bubble

I read the EIR, and examined your writings. Scary and believable. It gives me the impression that out government knows the inevitable, but they have taken measures to delay it. When do you think the real estate bubble will burst? Do you have a month in mind or a broader period? Will it happen this year or next?

Reply, from Europe, to yours of Aug. 28, 2002:

"Government" as such does not know the early future of the economy.

Some people in government have recognized the consistent accuracy of my forecasts; but, the President does not, and others, such as Rumsfeld say that, since we are going into a period of perpetual wars around the world, what is happening inside the U.S. economy now is irrelevant.

On the subject of timing. All competent forecasting takes human free will into account. We can, and should foresee the boundary-conditions which define the consequences of taking either non-choices, or some available choice. We can foresee the consequences of each decision by the same method. But, while we can forecast the probable choice preferred by each of various institutions, groups, and even individuals, we can not predict with certainty exactly what choice will actually be made. We approximate certainty when we take into account theconsequences which would result, inevitably, for each type of choice, or non-choice made; we can foresee the probable consequences of each choice to a high degree of precision, as in the case of the man choosing to walk across a bridge which isn't there.

Hence, all my forecasting is based on long-term forecasting, from approximately five years, to a generation or two ahead. No forecast of that type which I have published has ever turned out to be mistaken.

The related significance of long-term forecasting is, that the significant consequences of most selections of a pathway of policy of practice, has cumulative effects which reveal their consequences five years, to a generation, or more, ahead.

For example, I forecast in February 1982, that if the Soviet government rejected my proposal, were President Reagan to support it, the Soviet economy would collapse "in about five years." The President did deliver that offer. The Soviet government summarily rejected it; the Soviet bloc plunged into an economic collapse just over six years after I first delivered that forecast.

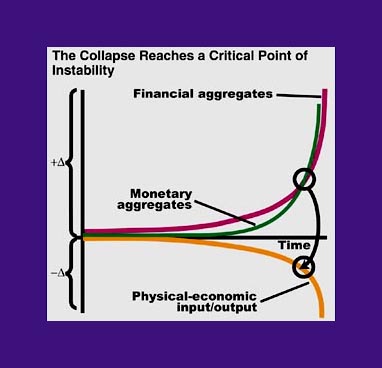

For example, in a report first presented to a late 1995 Rome conference I presented the forecast associated with my now widely circulated "Triple Curve" figure. The world monetary-financial system went into a tailspin during the 1997-98 interval. The G-7, led by the Clinton administration, reacted to the successive monetary-financial crises of 1997-1998, by the great financial swindle which came to be known as "the plunge-protection team." As a result of delaying the 1998-1999 collapse, by that method, the Clinton administration led the world intothe much worse collapse of the 2000-2002 interval. Since I knew that the Bush administration would react to the crisis with a worse-than-Hoover blockheadedness, I successsfully forecast the crisis of the Bush economy in an international webcast delivered prior to President G. W. Bush's inauguration.

What is demonstrated by that a related examples of my unique success as a long-range forecaster, is that, hereafter, no competent government will make policy without the guidance of my forecasting methods.

- - Lyndon

On Depression/Hyperinflation

Autumn, 2002

To: schiller@schillerinstitute.org

Subject: Depression/Hyperinflation

Does your definition of an economic depression differ from that of mainstream economists? Also, you've been predicting hyperinflation for some time now, yet inflation remains relatively modest. When do you expect hyperinflation to manifest itself in the economy?

Mr. LaRouche's Reply

Contrary to reports you appear to have received, the hyperinflationary spiral is already in full swing.

I am reminded of the case of the Japanese swordsman who passed his blade through his opponent's neck.

"Missed me!" grinned the opponent.

"Try shaking your head," the Japan swordsman retorted.

The website of EIR magazine(http://www.larouchepub.com) contains a straightforward analysis of both the analytical and statistical comparison of the present U.S. hyperinflationary spiral, to to Germany hyperinflationary spiral of June-November 1923

- - Lyndon

Note from Webmaster-- See also Mr.LaRouch'es Conference Speech of Aug. 31, 2002, and the accompanying charts-- Click here to link.

On the Euro and the Dollar

Summer, 2002

To: schiller@schillerinstitute.org

Subject: question

Mr. LaRouche,

I am a part-time student organizer for your campaign in the Washington, DC and Baltimore, MD area. I have a question concerning the euro as a form of currency recognized worldwide.

In recent months, I have noticed that the value of the US dollar has dropped below that of the euro. Since its initiation, I have viewed theeuro as strong opposition to the dollar. This seems to make sense,since the dollar is strong because of its unification as a monetary unit between the 50 states, and the euro seems to do the same for Europe.

My question is the following. How does the relative value of the dollar as compared to that of the euro reflect the economic conditions in the United States and worldwide? Does the euro - both in its current form and any other, potentially better, forms - represent a tangible threat to the economy of the United States, immediately or over an extended period of time?

A related question is, what sort of competition - if any - should there exist between the economies of the United States, Europe, and other countries of the world?

Thank you.

Mr. LaRouche's reply:

The Euro and the Dollar are both collapsing, headed into the greatest combined collapse of monetary, financial systems since the end of World War II. It happens that the U.S. dollar, whose exchange-value was the most overestimated, is now collapsing at a faster rate than the collapsing Euro.

The problem is, that under the present world monetary-financial system,all national economies have been operating on the basis of increasinglyinsane policies, and the relationships among them have becomeincreasingly cannibalistic. Without the drastic reforms I am pushing, there is no hope for either the U.S. economy or the European. The return to something like the 1945-1958 IMF system of fixed-exchange rates, and a gold-reserve basis, is the only hope for any among these nations, the U.S. included, provided this reform is made soon. Under such a return to a fixed-exchange-rate system, with a diissoluton of the WTO and banning of free-trade and montarist policies, construction cooperation would probably be more or less inevitable.

- - Lyndon

Summer 2002

On von Mises

On LaRouche Family History

Subject: RE: Two questions

Dear Mr. Larouche:

1. I don't recall your spending much time discussing the economics of Ludwig von Mises and contrasting his views (somewhat negative I believe) on the American system with your own. Have you written about this, especially given the growing influence of the the Mises Institute?

2. Larouche is a prominent name in Quebec history and I wonder if you've done any research in your own family history?

Thank you.

Mr. LaRouche's response.

1. I am familiar with the relevant aspects of the work of von Mises and the relevant institute. There is nothing notable about both which we have not covered in many references to the positivist school in general. Therefore, I had no recent occasion to add new comments on what I said, about his work, in passing, during lectures I gave at sundry college campus lecture-series during the 1966-73 interval. Von Mises' has only political significance, but no scientific points of interest. It is sufficient to view it as just another brand-name for the generic stuff circulated under brand- name labels such as Mont Pelerin Society and American Enterprise Institute.

2. About seventy years ago, at an extended family gathering in Beverly, Mass., some relatives, who had researched Church-kept genealogical records of Quebec, delivered an elaborate report on the branch of the Quebec Larouche tribe which had developed relations, through marriage, with a branch of the Parent tribe. My great-great grandfather, of Quebec, was one Antoine Larouche, known locally for his violins, and my middle name, Hermyle, was bestowed in honor of an ancestor named Hermyle Parent.

- - Lyndon H. LaRouche, Jr.

schiller@schillerinstitute.org

The Schiller Institute

PO BOX 20244

Washington, DC 20041-0244

703-297-8368

Thank you for supporting the Schiller Institute. Your membership and contributions enable us to publish FIDELIO Magazine, and to sponsor concerts, conferences, and other activities which represent critical interventions into the policy making and cultural life of the nation and the world.

Contributions and memberships are not tax-deductible.

VISIT THESE OTHER PAGES:

Home | Search | About | Fidelio | Economy | Strategy | Justice | Conferences | Join

Highlights | Calendar | Music | Books | Concerts | Links | Education | Health

What's New | LaRouche | Spanish Pages | Poetry | Maps

Dialogue of Cultures

© Copyright Schiller Institute, Inc. 2002. All Rights Reserved.