Highlights | Calendar | Music | Books | Concerts | Links | Education | Health

What's New | LaRouche | Spanish Pages | Poetry | Maps

Dialogue of Cultures

New Silk Road Requires

A New Monetary System

by

Dr. Jonathan Tennenbaum

October, 2003

This speech was presented to the conference, “Vision for Korea as a World Trade Hub” on October 31, 2003 in Seoul, Korea. Some subheads have been added for publication.

I want to thank Korea Trade Research Association for the opportunity to address your learned audience on two closely connected topics of decisive importance to the world's future. The first, is the present global financial crisis and what to do about it. The second, is a grand strategy for the economic development of Eurasia over the coming 30 years. This centers on the creation of a “Eurasian Land-Bridge System” or “New Silk Road” inter-linking the population centers and major development regions of Europe and Asia by a network of transcontinental infrastructure corridors, including high-speed ground transport, modern energy, water, and communications systems.

Let me explain why there is no way to adequately address either of these two topics without addressing the other. The conceptions I present are based in large part on the work of Lyndon LaRouche, the well-known American economist and statesman, who is one of the Democratic pre-candidates for the U.S. Presidential elections in 2004. Mr. LaRouche would have liked to be here to address you in person, but unfortunately previous commitments required his presence.

The world is presently suffering a combined financial and economic breakdown crisis, more profound—and potentially more devastating on a global scale—than the so-called Great Depression and the unleashing of the Second World War. This breakdown crisis comes as the terminal stage of a more than 30-year process of structural decay of the world economic and financial system. This decay was initiated by a fundamental shift in culture and economic outlook in the United States in the mid-1960s. At that time, the United States and other industrial nations began to move away from our previous tradition of highly-regulated, industrial-oriented national economies—a system which depended on large-scale state investments into infrastructure, science, and education. Instead, there was a revival of the ideology of the British “free trade” system of Adam Smith, which was promoted by Friedrich von Hayek, the “Chicago School” of Milton Friedman, the advisors to Margaret Thatcher, and the neo-conservative movement in the United States.

This change in Western policy led to a radical deregulation of the financial system, elimination of protectionist measures, radical privatization, reduction of state investment into basic infrastructure, and a policy of “globalization” of financial markets. Investment flows shifted away from the real, productive sector, more and more towards purely artificial, speculative profits in real estate, stock markets, futures markets, and an exaggerated growth of service employment. This process, accompanied by a terrible ballooning of debt, has finally rendered today's global floating-exchange-rate financial system hopelessly bankrupt. It cannot be maintained in its present form.

Simultaneously, we have had an accelerating decline in the performance of the real physical economies of nearly all nations, as measured against levels of physical investment required for net maintenance of basic infrastructure, productive capacities, real material living standards, and the quality of labor force. The recent epidemic of breakdowns in the electric power systems of the U.S.A, Canada, and Europe, highlights the vast and growing deficit of physical investment in advanced-sector nations.

Alternatives to Collapse of Dollar System

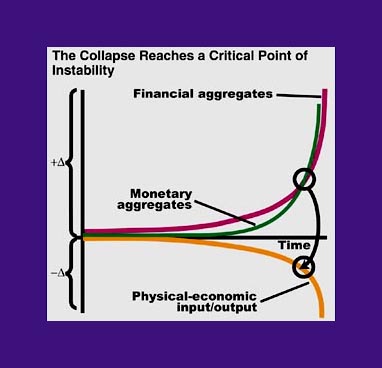

The essence of the present global crisis is best summarized in a schematic diagram called the Triple Curve, first presented by Lyndon LaRouche in 1995. The horizontal axis represents time, while the three curves are, from top to bottom: 1) growth of total nominal value of financial assets; 2) growth of monetary aggregates; and 3) net physical growth of the real economy, measured in production of necessary goods and services, after subtracting the physical investment required for maintenance. The hyperbolically growing gap between the growth of the first two curves, and the decrease of the third, shows the system as a whole cannot continue, empirical data from the U.S. economy 1996-2002).

|

||

The same trend is found in the United States, in Europe, and in nearly every economy in the world, with the exception of China and possibly a few other countries. We now face the prospect of a dramatic fall of the dollar, likely coupled with a crash of the real estate bubble in the United States—with, also, unsustainable trade and current-account deficits, state and local budgetary crises, and unsustainable foreign and internal debts. Such a dollar crash will result in a sharp drop in U.S. imports, and other shock effects which would trigger a major crisis in Europe and Asia, especially China, Korea, and Japan.

The governments of nearly all the world's nations have refused to acknowledge the deadly, systemic nature of the crisis. At best, they have paid attention to some symptoms, while allowing the disease to continue. Attempts to accommodate to the worsening financial environment through budgetary austerity, or by stepping up deregulation and privatization, have made the crisis far worse. The exception is Malaysian Prime Minister Dr. Mahathir bin Mohamad, who has made repeated sharp criticisms of globalization and deregulation. While he lacks developed alternatives, Mahathir did urge at the UN on Sept. 25, that the global system is not working, and that “exchange rates should be fixed by an international commission [such that] no profits may be made by speculating or manipulating exchange rates.” This is the first call by a head of state for a new global financial system, rather than a regional bloc.

Recently, other European and Asian governments have begun to wake up to the dimensions of the crisis, and to take certain actions which, although not adequate, point toward a positive solution. In the East, there is a growing tendency toward strategic cooperation among Asian and Eurasian nations, such as ASEAN: “ASEAN+3” including Korea, Japan, and China; the “triangle” Russia-China-India; and other combinations, discussing joint action on economic and financial issues, possible new monetary institutions, and cooperation on large-scale infrastructure development. Meanwhile, a large array of infrastructure projects have been recently initiated, or are already in construction, which could form the backbone of a Eurasian-wide economic development boom. These include: the “Iron Silk Road” Trans-Korean/Trans-Siberian/Trans-China railroad links; the Greater Mekong Development plan; Trans-Asia road networks; the Kunming-Singapore rail project; the Qinghai-Tibet rail link; the opening of the Nathu-La pass between China and India; major water projects in China, and so forth.

In early October, the UN Economic and Social Commission for Asia and Pacific (ESCAP) at a conference in Ulaanbaatar, Mongolia, began organizing the first historic shipments across the Trans-Korean Railway to Europe, scheduled for early to mid-2004. A “trial run” of freight containers on block trains is to travel from Busan, via Seoul and Pyongyang, to Ulaanbaatar and all the way west to Helsinki. If North Korea agrees, it will likely be the first full passage along the Iron Silk Road/Eurasian Land-Bridge to use the Trans-Korean Railway and actually bridge the Pacific and Atlantic oceans over land.

In Europe, there are important proposals to drop the anti-production austerity restrictions in the Maastricht accord, and to opt instead for a “New Deal” policy of large-scale state investments in infrastructure, to initiate an industrial recovery. When Italy assumed chairmanship of the European Union, Italian Finance Minister Tremonti proposed a new Action Plan for Growth, described by him as “a European New Deal,” for the creation of a New European Investment Facility to generate major new financing for an expanded program of infrastructure projects in Europe, including especially the accelerated development of high-speed railroad links.

Yet these and related initiatives from Asia and Europe, while in the right direction, fall far short of what is needed to prevent disintegration of the world financial system and an unprecedented world depression. To be blunt, as Koreans well know, there is no way out of the present crisis without a fundamental change in policy in the United States. So far, the only leader to propose a comprehensive solution to the global financial and economic crisis, featuring action by the U.S.A itself, is Lyndon LaRouche. This is the core of his Presidential campaign, and his policy recommendation to the Bush Administration. LaRouche's proposals involves these key elements:

- Elected governments to reorganize national financial systems;

- Create new state credits for large productive projects;

- Focus on infrastructure and new technologies to transform industrial base.

Emergency Action by U.S. and Other Governments

In concert with governments of other major nations, an American administration must assume control of the financial system, and carry out the equivalent of a bankruptcy reorganization, freezing and/or writing off a large amount of unpayable debts and speculative financial paper, and establishing a new world financial and monetary system. This must incorporate the most positive features of President Franklin Roosevelt's original 1944 Bretton Woods agreements. They include rigorous regulation of financial markets, relatively fixed currency parities, and a gold/foreign exchange reserve or equivalent reality-based reserve unit.

LaRouche proposes we recognize, that to do this, today's dominant influence of private financial interests, over the central banking systems of the OECD and most other nations—which is un-Constitutional—must be eliminated: “These so-called 'independent' central banks are only independent of elected governments, which are powerless to influence them. But they are highly dependent and controlled by self-interested financiers who have no concern for the general welfare of the population. We require a return to national banking systems, in the spirit of the American Revolution and Meiji Restoration, in which control of credit-creation and overall credit flows lies in the hands of the elected sovereign governments.”

Governments must utilize their sovereign power, via both national banking and long-term trade agreements between nations, to create virtually unlimited amounts of new, long-term, low-interest-rate credit at 1-2% per annum, for investments into the productive sector and related hard-commodity trade. Focus high-priority credits on a package of large-scale infrastructure projects and related high-technology investments, centering on the development of the Eurasian Land-Bridge system, with analogous Great Projects in the Americas and Africa.

This does not mean, of course, that the world should sit by and wait, until the U.S. acts properly. Sovereign nations, including the Republic of Korea, must now take sovereign action to do everything in their power, to protect their economies and populations, and to initiate cooperation as outlined above. The actions of all governments must be guided by the same essential principles, founded on the primacy of the sovereign elected nation-state.

In view of the importance of this, allow me to quote from LaRouche concerning the actions he would immediately take, as President, for a reorganization of the global financial system and a revival of world economic development. I quote from LaRouche's April 28, 2003 policy statement, “A World of Sovereign Nation-States”:

It is my intention to call the representatives of nations together, in an emergency conference sponsored by the U.S.A., for a general reform ... of the presently bankrupt monetary-financial system. Governments must face the challenge, that the present system is hopelessly doomed, and that the following types of measures are therefore urgently required.

- All relevant monetary-financial institutions, including central-banking systems, would be taken in receivership by the sovereign authority of the nation-state. This would require the support and cooperative assistance of all the governments party to the agreement.

- The first concern is to prevent a chaotic degeneration of the existing essential, public and private institutions of deposit, to protect the personal, modest financial assets of individuals and households, sustain the pensions of ordinary people, maintain the traditional institutions of supply of credit, and, to ensure the orderly continuation and improvement of essential production, trade, local government, and general welfare. Financial assets with the character of gambling, such as financial derivatives, would be largely eliminated, and many other forms of debt taken in custody for reorganization.

- We must mobilize sufficiently increased employment in sound investments to bring the total current costs and expenses of the national systems above annual breakeven levels. The principal stimulant for this will be governmental operations in basic economic infrastructure, or government-sponsored investments in regulated public utilities which are either partly, or entirely government-owned. In cases deemed appropriate, a public utility may begin life as government-owned, and later shifted to private ownership.

- The future of the individual national economies will depend largely on national and international mechanisms among governments, for generating low-cost, long-term credit with maturities of between a quarter and half-century.... Generally, this means borrowing costs for credit created at standard rates not in excess of 1-2% annual simple interest. This requires a well-regulated, fixed-exchange-rate monetary system whose design were modeled on the best features of our experience under the pre-1971 Bretton Woods monetary system.

- Two kinds of sources for the creation of state credit are available. The first, is a national banking system of the type implicitly specified by the U.S. Federal Constitution. The second, is credit generated by long-term treaty agreements on trade and investment, between, or among sovereign states The economic revival of Europe during the two decades following 1945, depended upon the unique role of the gold-reserve-backed U.S. dollar. This exceptional position of that dollar, during that interval, enabled the IMF system to shield European and certain other currencies and their credit systems, until the sterling-dollar crises of 1967-71. In today's crisis, we must accomplish a similar benefit at a time the U.S. dollar is inherently weak in real-value content.

- The principled features of the emergency reform to be made now, have the advantage of experience: a change premised on the proven success of the fixed-exchange-rate producer-society model, in contrast to the calamitous cumulative failure of the subsequent, doomed, deregulated, floating-exchange-rate model. Therefore, once it could be assumed, that the bankrupt, floating-exchange-rate form of the IMF is being replaced by an essentially global, regulated, fixed-exchange-rate version of the Bretton Woods system, it is feasible to use the intended monetary system as the context for long-term, reciprocal, bilateral and multilateral trade and tariff agreements of 25-to-50 years span.

These treaty life-spans of such duration are defined chiefly by the dominant role of component elements representing long-term programs of development of basic economic infrastructure: regulated generation and distribution of power; mass-transportation systems for freight and passengers; water resources development and management systems; forestation, and other large-scale land-management and related systems; sets of urban-industrial complexes; and health-care and educational systems. These programs, typified by the multinational Mekong development agreements, and the presently expanding array of China's infrastructure programs, define the market for stimulation and financing of expanding arrays in the entrepreneurial and related production of marketable goods.

The long-term infrastructure elements define the market which is the economic water within which the happy entrepreneurial fish swim. The life-span of the relatively longest-cycle infrastructure investments, defines the span within which payments must be resolved by pre-agreements on financing, tariffs, pricing, and trade.1

Eurasian Land-Bridge's Key Role

Thus, LaRouche links his proposal for reorganization of the world monetary system to large-scale infrastructure development world-wide. This has several missions:

First: It revives the productive sectors, expanding industrial demand, expanding employment and investment, by channeling large amounts of new state credit into great projects for modern transport, energy, water, communications, and related infrastructure. The proposals echo the methods by which President Franklin Roosevelt successfully ended the U.S. Great Depression of the early 1930s—typified by the successful Tennessee Valley Authority (TVA) water and electric power program.

Second: It sharply increases the overall physical productivity of the world economy as a whole. Large-scale infrastructure improvements provide the single most efficient means available to national governments, to achieve that effect. The projected, sustained increases in the net wealth-production of participating economies, secure the process of credit expansion in a non-inflationary manner.

Third: It opens up inland “hinterlands” and other underdeveloped areas, and provides optimal conditions for urbanization, agricultural and industrial development, by using infrastructure corridors as an instrument of development policy. This policy builds upon the successes of the transcontinental railroads in the United States; the role of Count Sergei Witte's Trans-Siberian Railroad in the industrialization of Russia; and many other historical successes.

Fourth: It re-establishes a proper and healthy relationship between the financial system and the real wealth-generating processes of the economy, by preferential channeling of credit into programs of productive investment—combined with the financial reorganization measures indicated. This puts an end to recent decades' dangerous generation of financial bubbles. With this, there should be no confusion, between LaRouche's production-oriented policy, and the misguided “Keynesianism” which has been a major feature of the disastrous transformation of the United States and other nations from industrial into “post-industrial” or “service-sector” economies.

Let us now discuss in depth the “New Silk Road” or “Eurasian Land-Bridge” system of transcontinental development corridors, the most important package of large-scale infrastructure projects in the world. To understand the world-wide economic impact of this, look at the distribution of human population on the planet.

Connected by a single continuous landmass, Europe, Southern and Eastern Asia comprise the largest concentrations of human population, accounting together for about three-fourths of the total on this planet. At one pole we have Europe, a unique concentration of scientific-technological and advanced industrial potentials. At the other pole we have East and Southern Asia with their enormous population, vast natural resources, and significant, and growing, industrial capabilities. Integrating these two poles together through a network of high-efficiency infrastructure corridors, and using those corridors as instruments to promote the rapid development of the relatively backward interior areas between them, has the potential to unleash a sustained period of real economic growth over the next 30-40 years.

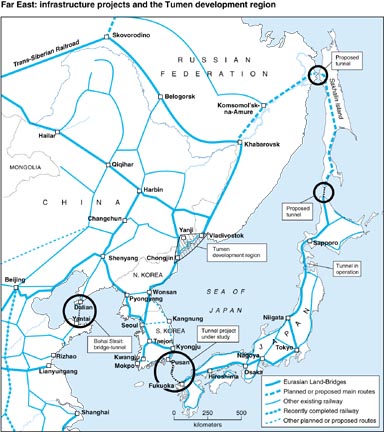

Figure 3 showed us the main corridors of the rapidly-emerging “Eurasian Land-Bridge” rail network. Although much of the total railroad mileage on this map already exists, enormous investments are required to modernize and upgrade the lines, especially for higher-speed transport, to complete a number of important gaps in the network. In addition, transforming the rail lines into true “development corridors” will require countless additional transport, energy, water, and communications infrastructure.

In the north we have the existing transcontinental line, running from Berlin to Vladivostok via the Trans-Siberian railroad. Needless to say, restoration and modernization of the Trans-Korean railroad network and its connection with the Trans-Siberian railroad is one of the highest-priority projects. Of global importance are both the TKR-TCR-TMGR-TSR (Trans-Korean/Trans-China/Trans-Mongolian/Trans-Siberian) route which requires completion of the Kyongui Line connecting Seoul and Pyongyang to China, in the west of Korea; and the TKR-TSR (Trans-Korea/Trans-Siberian) route, which requires the Donghae Line, in the east of Korea. These overland rail routes between Korea and Europe not only promise large savings in transport time and cost, as compared to sea routes, but will greatly promote regional economic development.

The whole region adjacent to the Sea of Japan, down to the Bohai Strait, comprising the eastern-most region of Russia, the Korean Peninsula, Japan, and the Northeast region of China down to Shanghai, seems predestined to become the single most powerful region of the world economy. Here we find a high degree of complementarity: the industrial capacities in Japan, Korea, and Shanghai; the vast mineral and energy resources, as well as scientific and technological potentials in the Far East of Russia; the food production areas in northern China; the huge potential market defined by the population concentrations in and around the region.

The Southern Eurasian Land-Bridges

In 1992, with the completion of a missing link across the border from China to Kazakstan, a second transcontinental rail link was created, referred to in China as the “Second Euro-Asian Land Bridge,” and running from the Pacific port city Lianyungang, to Europe's Atlantic port at Rotterdam. This line, also known as the “Trans-China” corridor, will provide a third route from Korea to Europe, connecting with the Kyongi Railroad. Besides linking Asia to Europe, these two Land-Bridges also provide a potential new transport route between East Asia and the East Coast of the United States (see “New Eurasian Land-Bridge Infrastructure Takes Shape,” EIR, Nov. 2, 2001, for maps of all the major infrastructure projects discussed here).

Recently, a series of international seminars have been held to discuss a “Northern East-West (N.E.W.) Freight Corridor” which would run from the East Coast of Asia via the Trans-Siberian and Trans-China corridors, via Finland and Sweden to Norway's all-weather port at Narvik, and from there by ship to the ports of Halifax and Boston on the East Coast of North America. Meanwhile, preparatory work is proceeding on another route from China to Europe via Central Asia: a link from Kashgar in West China to the cities Osh and Jalal Abad in Kyrgyzstan, with additional connection to Biskek. Kashgar, a famous outpost of the legendary “Silk Road,” was connected into the Chinese rail system at the end of 1999, when China completed a new 1451 kilometer-long link from Kashgar to Tulopan (Turpan) on the main line of the Second Eurasian Land-Bridge. Osh and Biskek are both linked northward to the Russian rail system, all the way to Europe. The Kashgar-Kyrgyzstan link would thus open a new transcontinental line, sometimes referred to as the “Shanghai-Paris Railroad.”

Conscious of the key role of Persia in the old Silk Road, Iran very early realized the implications of a new era of Eurasian-wide development, and has taken measures to secure its position as a strategic nodal point between Europe, Central, Southern and Eastern Asia. In 1996 an important, 300 kilometer rail connection was completed from Mashhad in Northern Iran, to the Tajan and Sarakhs in Turkmenistan. Thereby, a new, “middle corridor” was opened up, running from China through Central Asia down to Iran, and then via existing railroads in Iran and Turkey into Southern Europe. Earlier, Iran had completed a 700 kilometer rail line from Bafq to the strategic Persian Gulf port of Bandar Abbas, thereby providing an important potential access to the sea for a vast interior region of Eurasia, including the landlocked Central Asian republics. Moreover, in September 2000 the transport ministers of Russia, Iran, and India signed an agreement for cooperation in the creation of a new north-south multimodal transportation corridor, running from the western ports of India, via Iran, by ship over the Caspian Sea to the Russian port of Astrakhan, and from there by rail to Moscow and beyond....

At present, there are no rail links at all among Vietnam, Laos, and Cambodia. Among the economically most important projects in Southeast Asia, which is now moving through the planning stage, is the 5,500-kilometer-long Kunming-Singapore rail corridor. Of far-reaching significance is the extraordinary progress in relations between India and China recently, which has led to the June 2003 agreement to open the famous Nathu-La Pass providing the most direct north-south connection between the two nations. Also of great significance is the construction of the Qinghai-Tibet railroad in China, connecting the city of Llasa into the Chinese national rail system. Begun in June 2001 and scheduled to be completed in 2007, the 1,118-km-long line from Golmud to Llasa will constitute one of the engineering wonders of the world. Some 960 kilometers of the line are located at altitudes of more than 4,000 meters, and 554 kilometers will be built on permafrost foundation. Passenger wagons will have pressurized cabins.

At the same time, the road connection from Llasa to Gangtok in India is being upgraded on both sides into an all-weather four-lane highway.

Development Corridors

Let me now add three additional points concerning the Eurasian Land-Bridge system as a whole.

Firstly it is necessary to overcome the short-sighted tendency to think of the various transcontinental routes—particularly Russia's Trans-Siberian railroad and China's Second Eurasian Land-Bridge—as competing against one another. Surely, when it comes to connecting nearly 1 billion people in Western, Central, and Eastern Europe, with 3.5 billion people in Asia, two railroad lines will not be too many! On the contrary: In the not-too-distant future, more lines will have to be built and new technologies implemented, to handle the gigantic transport volumes that will be generated by Eurasian economic development and growth. Furthermore, the network character of the Land-Bridge system, if properly developed, will be such that the increase in activity in any one corridor, will tend to enhance activity in all the others.

Secondly, the potential of the Land-Bridge system, as proposed by LaRouche, to generate a sustained period of economic growth throughout Eurasia, depends upon combining or “bundling” transport, energy, water, and communications infrastructure within certain band-like regions—“infrastructure development corridors.” A crucial challenge in the economics of the Eurasian landmass is how to develop the huge interior regions, which lack basic infrastructure to support economically viable investments into modern production. The long transport distances, lack of access to resources, markets, and services, and low density of population, combine to reinforce permanent under-development.

The most powerful approach to the problem, is building a network of infrastructure development corridors. This means: 1) building up a basic network of high-efficiency, high-speed transport lines reaching into the hinterland—above all rail lines, navigable rivers and waterways; and at the same time, 2) concentrating additional investment into creating a dense network of secondary “capillaries” in the form of transport, energy, water, communications, and other basic infrastructure within the band-like regions located along the main transport lines. These infrastructure corridors, typically extending 50 kilometers on both sides of the main transport lines, provide ideal conditions for rapid development of intensive agriculture and modern, high-technology industry, and for urbanization.

|

||

The economics of such development corridors is thus completely different from that of a simple transport system. Rather than simply to connect point A to point B, the concentration of industrial activity along the development corridor transforms it into the equivalent of a production-line “conveyor belt,” in which value is continuously added to the flow of goods as they move through the system. At the same time, the system of corridors, with their high concentration of population and economic activity, and high efficiency in distribution of goods and services, constitutes a vast and rapidly-expanding market....

Third, the Land Bridge infrastructure corridors should make use of the most modern technologies available—the technologies of the 21st Century. Not only does this guarantee the highest physical efficiency of the infrastructure itself, but it transforms the infrastructural investment into a means for injecting new technologies into the entire productive base of the economy.

Exemplary of the technologies of relatively greatest importance to the Land Bridge development are the following:

- Automated systems for management of multimodal container transport, including loading and unloading between transport systems and storage areas, and computer- and satellite-assisted tracking;

- Rail cars and locomotives capable of operating on the different rail gauges and power characteristics of the Eurasian system;

- Magnetic levitation (maglev) transport systems for passengers and freight. The German Transrapid, a first-generation maglev system now in commercial operation in China between Shanghai center and Pudong airport, is presently the most advanced ground transport system in the world. Operating routinely at speeds of 450 kilometers per hour, and able to achieve much higher acceleration rates, tighter curves, and steeper inclines than conventional high-speed rail, the Transrapid provides an optimal mode of passenger and high-value freight transport between population centers, far more efficient than short- and medium-range air travel. The same technology can be adapted for high-efficiency automated transport of container freight over long distances. Furthermore, the linear-motor technology used for propulsion of maglev vehicles can be fitted to existing, conventional rail track, transforming it into a “conveyor belt” for automated transport of container pallets between arbitrary destinations.

- Modular high temperature reactors (HTR) for production of electric power and industrial process heat. The HTR technology, particularly in the so-called “pebble bed” form employing spherical fuel elements, provides the advantages of intrinsic safety (serious accidents are excluded by physical principles, without expensive active safety systems); low-cost, modular construction (assembly-line construction methods); high-efficiency electricity production through direct-cycle helium turbines; production of high temperature (900-1,000°C) process heat for industrial use, including production of hydrogen and other synthetic fuels; and lower-temperature process heat for processes such as nuclear desalination of sea water.

No Way in Present Failed Monetary System

Hearing about the Eurasian Land-Bridge policy for the first time, people commonly ask, “Where will all the money come from, to finance these huge investments?” The answer lies in the first half of my presentation, where I laid out Lyndon LaRouche's policy for a “New Bretton Woods” reform of the world financial and monetary system. There is no way, within the framework of the present world financial system, to generate the scale of long-term investments needed for the proposed, transcontinental system of infrastructure development corridors and the ensuing Eurasia-wide development boom. But the present system is hopelessly bankrupt, and will collapse onto our heads unless we put it through a bankruptcy reorganization first. On the other hand, the “New Bretton Woods” system proposed by LaRouche would not only permit such investments, but is expressly designed to rapidly make the Eurasian Land-Bridge a reality.

Notes:

[1] Lyndon H. LaRouche, Jr., “A World of Sovereign Nation-States,” EIR, May 16, 2003.

schiller@schillerinstitute.org

The Schiller Institute

PO BOX 20244

Washington, DC 20041-0244

703-297-8368

Thank you for supporting the Schiller Institute. Your membership and contributions enable us to publish FIDELIO Magazine, and to sponsor concerts, conferences, and other activities which represent critical interventions into the policy making and cultural life of the nation and the world.

Contributions and memberships are not tax-deductible.

VISIT THESE OTHER PAGES:

Home | Search | About | Fidelio | Economy | Strategy | Justice | Conferences | Join

Highlights | Calendar | Music | Books | Concerts | Links | Education | Health

What's New | LaRouche | Spanish Pages | Poetry | Maps

Dialogue of Cultures

© Copyright Schiller Institute, Inc. 2004 All Rights Reserved.