Highlights | Calendar | Music | Books | Concerts | Links | Education | Health

What's New | LaRouche | Spanish Pages | Poetry | Maps

Dialogue of Cultures

Presentation to

São Paulo Commercial Association

Lyndon H. LaRouche

June 13, 2002

'The Most Profound Crisis May Be a Gift'

|

||||

|

Lyndon H. LaRouche in Sao Paulo

photo credit- S. Meyer, 2002 |

||||

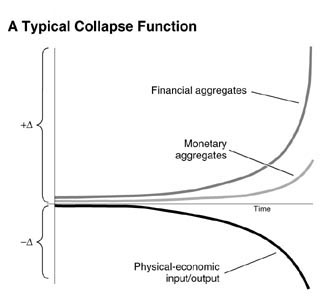

I shall use only one chart, which I think we should probably display at this time. I have some other charts which are available, if the questions may require their presentation. So, show the first chart.

This is a chart which I developed as a pedagogical chart, for use at a Vatican conference on the subject of health care. My challenge was, since I had a varied collection of people at the conference: How do you explain economics to priests? The advantage is, that probably everyone will tend to understand it if priests do. What this chart represents, is an idealized representation, of what has happened to the U.S. and world economy since approximately 1966. Now, before going into the details of this, let me just qualify what I mean when I refer to 1966.

|

|

So, the great power that the United States represented in 1945, was the fruit of Roosevelt's response to the Depression of 1929-1933. In part, Roosevelt began making fundamental changes, for example, breaking up of the last remains of the British gold-standard system, which was a change which led the way toward the later establishment of a fixed exchange rate monetary system, based on assigning a politically determined value for gold—gold not used as a basis for currency, but gold used as a reserve against current account deficits of nations.

FDR and the Post-War Period

Under the system which was created by Franklin Roosevelt, we had the following stages: Apart from drastic monetary and financial reforms, the President's concentration was on basic economic infrastructure. This had two functions. First of all, as had been proposed in Germany—although it was not known much at the time, that a certain Dr. Wilhelm Lautenbach had proposed to a secret meeting of the Friedrich List Gesellschaft, an argument saying that those who resort to what is called today "fiscal conservatism" as national policy, under conditions of bankruptcy, are dangerous idiots. That what the government must do is create credit, not to reduce employment, but to increase it. And the place to put the government credit for stabilizing the economy and expanding it, is the area of state responsibility and competence: basic economic infrastructure. It's the one place that you can quickly absorb a large number of unemployed persons, with a form of work which will be ultimately good for the nation.

The second purpose of Roosevelt's public works program was to prepare the basis for a general industrial and agricultural recovery. For example, the rural electrification program, which became the basis for the explosion of productivity of agriculture into the 1970s.

But in 1936, a new factor came in to shape this policy. The British had initially put Hitler into power in Germany, with the intention that Hitler would mobilize a war against the Soviet Union, and then the French and British would fall on the rear end of that process. The British suddenly discovered that the German general staff had prevailed upon Hitler to hit westward first. So, the British did a couple of things. They fired the pro-Nazi king, Edward VIII, to please the Americans, and they went to Roosevelt and said, "Help!"

So Roosevelt, in 1936, was already committed to the inevitability of a war with Germany, with all that that entailed. So, the way in which the reconstruction of the United States occurred, from 1936 on, was done with the war in mind, to create rapidly a then-nonexistent industrial capability for warfare.

This was done partly in secret; some of the key people in industry were assembled with Roosevelt; they worked out a national development plan; and what you saw from 1940 on, into 1943, was the greatest industrial mobilization in history. There were 16 million of us in military service. We won the war, not because we were the best fighters; the Germans were much more efficient in warfare. Their military training was much better than ours. We won the war with logistics, not by killing—though some terrible battles were fought, but with the overwhelming superior power of our logistics.

Roosevelt died, and the enemies of Roosevelt began to tear the place apart. The Roosevelt-haters took over control of the government. These are the financier interests, the old backers of Teddy Roosevelt and Woodrow Wilson and Calvin Coolidge. But nonetheless, we won the war. Many of us had fought in the war; we respected the tradition of our victory. So, the monetary system which the world received at the close of the war, contained most of the features, in terms of economic policy, that Roosevelt had prescribed.

Now, there is a myth which is popularly spread at universities, which is not true, that John Maynard Keynes designed the post-war monetary system. That is flatly not true. There is no Keynesianism whatsoever in Roosevelt's design for the post-war IMF. And I'd say, as an aside on that, the attempt to use Keynes or neo-Keynes as the basis for organizing a general financial recovery now would be the greatest failure of all.

Industry Has Been Destroyed Since 1966

The methods of the American System of political economy, the methods used by Roosevelt, as by Lincoln before him, as described by Treasury Secretary Alexander Hamilton, these are the methods by which every success of the United States has occurred.

Now, because of the war, because of the experience of the recovery under Roosevelt, the world benefitted, to a large degree, from Roosevelt's reforms. We had a monetary system which worked. It worked for the Americas; it worked for Western Europe under the Monet plan. Once the war in Korea started, it worked for Japan, too.

In 1961, President Eisenhower retired. Now, Eisenhower was a man who believed in the American military tradition, the tradition of strategic defense, known to us by figures such as General Douglas MacArthur and Eisenhower, especially. Eisenhower would not tolerate certain changes which the Wall Street crowd was trying to introduce. He denounced these, on leaving office, as the "military industrial complex." That is misleading; it's honest, but misleading, for what it didn't say.

The policy which grew up in the military and other institutions around the British monarchy and around our Wall Street, was to use the lessons of the Nazi Waffen-SS, to create a professional army, the way the British used naval power before in past centuries, but adding air power as a new dimension of the same function as naval power, to create an English-speaking world empire over the course of a generation or two. The changes in the U.S. military tended to push in that direction. Once Eisenhower was out of office—a man with the power of the President, who understood the implication of this military policy—once he was out, it turned loose. We had the Bay of Pigs, we had the assassination of Mattei in Italy, we had the 1962 Missile Crisis, the first attempted assassination of Charles de Gaulle, we had the ouster of MacMillan in England, and we had a process which led into the 1964 entry into a full-scale Indochina war.

The key thing was the assassination of President Kennedy. So, from 1966 on, this policy has been running rampant. We began to take down our industrial growth potential. [The start of floating-rate system in] 1971 was a global catastrophe, as you know here: the new monetary system. Worse than the Nixon Administration was the Carter Administration. But remember, we never had a Nixon Administration, we had a Kissinger Administration. We never had a Carter Administration, we had a Brzezinski Administration. Both of whom represent the same policy: the utopian policy which Eisenhower denounced as the "military industrial complex."

|

||

"The fundamental interests of the United States are as follows. In the Southern Hemisphere, there are vast natural resources. If we allow the populations of Africa and South and Central America to increase, then these people will develop technologically, and they will use the natural resources in their territory. And when we come to steal them later, they won't be there anymore."

The Economic Policy of Empire

This is National Security Study Memorandum 200. This is the same policy as the outgoing Carter Administration described as "Global Futures" and "Global 2000." This is the policy of the Club of Rome. This is the policy of the World Wildlife Fund. This is the policy. The policy is not concern for nature. These people, as I know them, there's nothing natural about them. They are unnaturally inhuman.

So, with this kind of policy, you've come to a point by which a great empire destroys itself. It is through the productive powers of labor, and increasing those productive powers, that we maintain economies. If you destroy the productive powers of a nation, you cannot live.

Now we have reached the point, right now, at which a President, who's not the most intelligent one we ever had, is now advised to launch world war against an enemy, who in large part is imaginary, but to kill anybody he might suspect of sympathy for this imaginary enemy. Against the advice of all the generals, he wants to have a war in Iraq.

What we have is this: We have [an] Anglo-American, English-speaking interest, which includes certain forces in Australia, which is now determined to establish a world, English-speaking, Roman-style empire, ignoring the fact that Rome started its empire at the height of its power. These fools are trying to establish an empire at the nadir of their power.

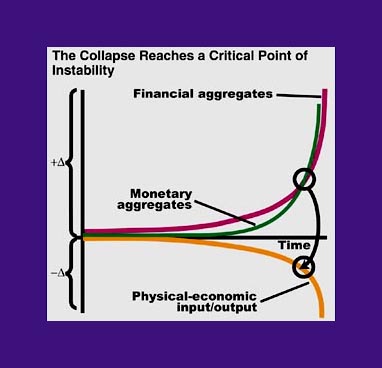

Now, look at the chart. As a result of this, what we have is a degradation in the physical productivity of labor per capita and per square kilometer. We're now in a rate of precipitous collapse.

What we also did, was we are pumping the system: we increased the amount of financial aggregate in the system. We did this largely by driving up monetary aggregates into the system. In the year 2000, a very interesting development occurred: 1923, Germany!

Germany had been financing its war reparations debt by printing money. This had been inflationary, but it occurred under world depressed conditions, so that there was not a precipitous growth of inflation in Germany up until June-July of 1923. In June-July, you had an explosion. The explosion was caused by one thing, because the chart was very similar to this one you're looking at here. What happened, as happened to the United States during the year 2000, was that the amount of monetary aggregate required to be generated to roll over existing financial obligations, was greater than the financial obligations rolled over. Whenever that happens in an economic system, you have a hyperinflationary skyrocketing in motion.

Put the System Into Bankruptcy

Now, in such a case, there is only one solution. Governments must act to put the system into bankruptcy reorganization. If you do not do it, you have the worst possible result.

Now, let's look at Brazil from that standpoint. Brazil, like every other nation on this planet, including Japan, is the victim of an Anglo-American dictate to try to perpetuate that bankrupt system. If we continue, this will blow up, and this could probably happen in the next two to three months. What is happening in Argentina is a warning: it could happen in Japan, explosively. Because Japan has been used to generate a great amount of the monetary aggregate on which the U.S. economy, the U.S. dollar, depends.

If Japan and the yen market collapses, and some idiots in the United States are trying to force it to collapse, the dollar will go next. Because the ability of the dollar to carry itself is dependent, marginally, upon a very large contribution of Japan from the overnight, zero-interest policy.

Now, briefly, just to wind this up.

What does this mean? This means we must think in several terms: First, we require a global, monetary financial reform. The best model we have is the 1945-1964 system, not as a perfect model, but as a political model. Under those, we must have, therefore, financial reorganization in various countries. We require an emergency monetary conference among leading countries, using the implicit emergency powers of government, to immediately negotiate a general reform and bankruptcy reorganization.

We must also, then, take certain steps in each country, and in treaty agreements to get the world economy moving upward. That means we have to have a protectionist system, because what many people don't understand, is the importance of capital cycles. Capital cycles generally go 25 years for long-range infrastructure development; 3-7 years for an agricultural program, even for an individual farmer; and for an industrial firm, a product-line may be 7-15 years.

Therefore, we must generate a tremendous amount of capital investment. How do we do that? We must create the credit system, but we must have a secure credit system. You cannot have international trade or loans at above 1-2 percent simple interest. Therefore we must have a fixed exchange rate. We probably should use a gold reserve exchange.

Then, we have to make certain changes in each country. Brazil is obvious. Brazil has absolutely tremendous potential. We have two areas. We have the domestic economic areas: we have infrastructure, which is primary. The energy requirements are overwhelming. Control and development of one's own energy resources. You need a science driver-led program of economic development and recovery, which Brazil already has in some areas, as in the health-science area, which is crucial, for example, for Africa. You must then have an educational system which can be built to produce the cadres for this expansion.

You must also have an emphasis on entrepreneurship. No accountant, working as an accountant, can cause an economy to grow. Growth comes from physical principles; it comes from the ingenuity of the entrepreneur. We see this in Italy, we see this elsewhere: the failure of the major corporations reveals what we always knew. A successful economy is always based on the entrepreneurial basis—they are the innovators.

The United States Must Change

And so, you must move in those kinds of directions, both in terms of each nation, in terms of cooperation across borders, and obviously, while other countries outside the Americas are extremely important, you must in some way induce a change in U.S. policy toward the Americas to pre-1982, pre-1971, and probably pre-1965 standards.

The United States has the political power. If we are in partnership with the nations of the Americas, if we can agree to make a program like this work—and we have the opportunity given to us, in the worst, most terrible form: When people become fat and lazy, a crisis may intervene that causes them to become human again.

If leadership is present, if the ideas are present, if an effort is made to recruit the population to support the policy, we can succeed. Therefore, as in history in the past, as in the United States of 1929-1933, the most profound crisis may be the greatest gift, to stop rotting and come to our senses, take leadership, and lead the people to new successes.

Click here, or scroll down for Dialogue with LaRouche

Press Release on Visit to Sao Paulo, Brazil

Alumni Association of the Superior War College (ADESG)

Presentation by Lyndon H. LaRouche

Gen. Oswaldo Muniz Oliva;

Congressman Marcos Cintra;

LaRouche Response to Commentaries;

Questions and Dialogue

Sao Paulo City Council

Dr. Havanir

Helga Zepp LaRouche

Dr. Eneas Carneiro

Lyndon H. LaRouche

Dr. Havanir, Concluding Remarks

São Paulo Commercial Association

Presentation by Lyndon H. LaRouche

Dialogue

Fifth"Argentina-Brazil, The Moment of Truth" Meeting

LaRouche Presentation

Colonel Seineldin Presentation

Helga Zepp LaRouche

Dr. Vasco de Azevedo Neto

Dialogue

Stop the 'New Violence,'Create a New Renaissance'

Helga Zepp LaRouche Speech to Sao Paulo State Appellate Criminal Court,

LaRouche Presentations in Sao Paulo

Dr. Renato Nalini

Dialogue With LaRouche

'When Do We Get To The Breakdown Point?'

Following his presentation, questions were asked to Lyndon LaRouche, and views presented, by business leaders in the Commercial Association of São Paulo. Paraphrases of the questions are supplied in italics, and LaRouche's responses given in full.

Question: I am not an economist; this is an extremely difficult science, a lot of talk with few concepts.... A lot of people make a lot of suggestions, and really don't know what they are talking about.

The only solution in the face of chaos, could be either that the large corporations wake up, or that we have to demand from them much more than they politically wish. I would like to know what you think about this subject.

LaRouche: Very simply: It comes from leadership. Don't wait for chaos; it may be too late. France could have been saved before July 14, 1789. The constitution of Bailly and Lafayette, had the king not rejected it, would have meant a great revival of France. As a result of the failure to enact that constitution, July 14, since 1789, has been celebrated in France.

I believe that people here, in Brazil, are thinking about the same thing. So don't wait for July 14, 1789 to hit Brazil. Therefore, the time to act, is as soon as possible. But, you have to wait for that hot moment where the response will be forthcoming, but don't wait beyond that.

Then, who can lead? What can you and the people you typify or represent do, in terms of leadership? If the people of Brazil, or a significant number of them, smell a disaster now coming across the border from Argentina towards Brazil, and say: "What do we do?" Someone has to answer. You, and people you know, must undertake the responsibility of educating yourselves and the people you know, in the practical aspects of this problem. If the people trust you, if they believe in those ideas, then under those conditions of crisis, you can be victorious. That's the lesson of history, repeatedly.

And therefore, the time to intervene, in that way—but the key thing to emphasize is, these kinds of changes never come from bureaucrats. They come from people who think as individual persons.

Let me just add one thing. In the German military system, as developed initially by Scharnhorst and then by the old Moltke, the principle of training of the non-commissioned officers and officers was called the Auftragstaktik, which means a mission orientation. Think of this from an entrepreneurial standpoint. Any lieutenant, any sergeant, assigned a mission, will probably face a situation entirely different than he expected. At that point, the outcome depends upon the ingenuity and the creativity of that lieutenant or that sergeant.

This was the secret of the German combat capability: Auftragstaktik. That's why the German unit was generally more effective than any other unit. There are many examples of that in U.S. military history, too. The point is, the entrepreneurial viewpoint is typical in society, because the successful entrepreneur applies the principle of Auftragstaktik to the economic situation he deals with.

Question: What is the future, in your view, of countries such as Brazil, particularly looking at the United States as one of the biggest players in the world, and keeping in mind that you have different factions, different tendencies? We, in Brazil, have been negotiating. We have been making concessions, and taking somewhat less. But, I would like to focus on what is happening today. Just this week we have been suffering a tremendous problem, paying the price of something which might happen, with candidates who might be elected in Brazil's general and Presidential elections this year, and may be a problem. As a Brazilian, I have been trying to figure out what can be done, what we can do to change that. To my mind, its largely speculation. If the United States—specifically the United States—would take a position in this case, we could probably avoid a lot of headaches.

LaRouche: For example, look at the case of—three different cases: Argentina, Brazil, the United States. Each of which has the same problem, but with different specific characteristics.

Argentina is in the most advanced stage of explosion. If the IMF proposals for Argentina, which are now being delivered, are accepted, then the nation of Argentina will disintegrate, almost instantly. Because those conditions do not allow the nation to exist as a nation. Chaos will be the result.

Now, take the case of Brazil. One gentleman who is very clever, in Brazil, has forecast great trouble for the first quarter of the year 2003. That is, the national debt, the ability to pay the debt, and the dollarization of the debt.

The United States is in a similar condition, but different. We are about to go under. We have a number of internal bubbles—the real estate bubble. The United States system is the greatest financial fraud on this planet right now. This thing is nothing but fraud, holding up Wall Street. And I mean fraud in a way that would cause a gangster to blush! Enron is only the tip of the iceberg. The worst danger in the United States is the real estate bubble, better called the "mortgage bubble."

If the United States does not receive about $3 trillion a month right now, in influxes, from sources like the Japanese—the Japanese money-printing press—and if the Japan money-printing press breaks down, then the United States dollar goes under.

Europe, the same kind of condition. Germany, same condition. Italy, a little more stable, for different reasons.

So, we are in a situation, where, by the Fall, by the end of September or beginning of October, we are entering an impossible area, beyond which you cannot calculate.

Now, this is the reason for the military problem. Why this push for a war in Iraq? There's no good reason for a war in Iraq. Nor does the United States have the capability to conduct such a war. They cannot go in and—and they have lost the war in Afghanistan already, and they want to go to war in Iraq. By all military standards, the Afghanistan thing is a defeat. They took the devil's son, and they got the devil himself.

So, under these conditions, the desperadoes in the United States believe that only a war will enable them to control the political situation inside the United States and in other nations.

So, obviously, in my position, I do certain things. As you may know, not everybody in the United States is an idiot. It only appears that way. There are—I have some old friends, and people who are not necessarily friends, but who respect me, and actually, we talk. And I press them: We've got to do something about this. And therefore, when I talk abroad, I say things that nobody else has the guts to say—not because I am foolish—even though that's dangerous. But in a sense, I was elected to do it. You know, like you're a soldier, and you're sent out to do a mission, you do the mission.

A True Conspiracy

Therefore, my being here, for example, in Brazil. Brazil is the key country of all South America, strategically. It's extremely important that I state here the same thing that I'm saying in other countries, so that people in Brazil know what I'm saying; so you can react to what I am saying. How you react to what I am saying is very important to people in the United States and elsewhere.

We are engaged in a true conspiracy. Not those nutty drawings that they make of conspiracy, but a real one. We discuss the situation. We discuss the ideas. We consider the possibility of agreement on ideas. We assess interests. We try to come to a common thing we agree on. I'm in the process of trying to push that kind of discussion internationally.

For example, last week I was in Abu Dhabi. I was there to give the keynote speech at a conference on petroleum, and I've had certain influence in the area recently. I also have my friends in India. So, in these discussions—I think the problem is, there is not enough of this discussion occurring across borders. Because no country can act completely independently on these issues—not even the United States. We must discuss what we're going to do about the situation.

The danger now, is we're not discussing what we should be doing. We are discussing how to try to keep this system from collapsing. How to work within the sinking ship, instead of saying: "The ship is going to sink, let's get off it and pick a new ship."

That is the great danger: that we're not discussing the alternatives adequately. And people scream. You say: "Go back to the original Bretton Woods agreement. This ship is sinking, let's try the other one; at least it worked. And what do we do?"

So, if we can come to an agreement on ideas, as a result of discussion, then we can discuss internationally, we can act in concert to cause governments to change their opinion.

Permit me to be very delicate, as delicate as necessary. You have a movement of chaos loose on this planet, it's called anti-globalization. It officially is led by a British agent, Teddy Goldsmith, who led a conference at Porto Alegre some months ago. That is the palpable, major internal danger to Brazil right now. And when I talk to people in Brazil, I find this subject comes up. And I say: "Well, what are you worried about? He's a globalizer, to globalize the non-existence of the nation-state, using Jacobin-terror methods."

Why is he able to attract people? As long as you say, "We've got to go with globalization," how can you fight him? How can you? You have no credibility. A question was asked of me in the discussion earlier: How do you deal with the people, and their representatives? You have to know how to deal with people, and the people want to know what the alternative is to the misery which they see coming down upon them.

And this movement—that movement at Porto Alegre—has no right to claim to be the anti-globalization movement. I am the anti-globalization movement, to save the nation state!

Question: I have followed your magazine, and the presentations which are published in the magazine. And your presentation was quite clear and objective.... If we consider how the two curves are diverging in ever greater fashion, between the production and the financial, it appears inevitable that a collapse of the international financial system will occur. And the realization of a New Bretton Woods has been proposed, but there is no sign, not in the United States, nor in Europe, nor other countries, that they are moving in this direction. Therefore, do we have the time to change this reality, and create a consciousness in favor of a new meeting? Or, will we have a collapse before this could happen? What is the envisioned time frame? How much time do we have available to avoid the collapse, if we do, indeed, have any time? This is my question.

LaRouche: This is a very difficult question to answer in particular, because—I think some of you have seen people going into bankruptcy. Some of you have been privy to some of the financial paper studied in those bankruptcies. And you ask the question: When did that firm go bankrupt? Usually, most firms went irreparably bankrupt long before the public knew about it. That's the situation with the United States economy right now.

The United States economy is bankrupt. Look at the current account deficit. Look at the way in which foreign investment into U.S. financial markets, plus the Federal Reserve money-printing—like Germany in 1923—is postponing the day of reckoning.

Now look at the pattern of bankruptcies in the United States: Enron; almost the entire so-called New Economy sector; international telecommunications—bankrupt! So that the United States is already bankrupt, hopelessly bankrupt. There are actually outstanding probably over $400 trillion of derivatives obligations hanging around in the system, which are nothing but gambling side-bets. They are not investments.

The question is, when do we get to a breakdown crisis, as opposed to a bankruptcy? It is the political power of the United States to extract, from Japan and other countries, the support needed.

Take the case of Argentina. Why is the crazy IMF sending these gravediggers down to Argentina? And you have these foolish people in Argentina, with blowtorches, trying to go in and get the money out of the bank. When there is no money in the bank. So what the crazy IMF is doing, is demanding conditions of Argentina, which are causing the disintegration of Argentina as a nation. Why are they doing that? To maintain the principle that any debt which is owed to a New York banker will be paid, if they have to sell the Argentine babies for hamburger to do it!

You are dealing with a system which is of that character. So it's now. The question is, when do we get to the breakdown point? And we're close to it. Germany is operating at a loss. The entire European Union is operating at a loss. Spain is about to go under because of the chain-reaction effects of their investments in South America. So, this is the problem.

So, we have a window of opportunity, before a political breakdown occurs, in which to come to our senses. But, as in a bankruptcy, if you've been through it, as I know from former times as a consultant—I used to be the undertaker.

Question: Yesterday, the Italian Security Minister was here, who fights organized crime.... How much money is in the hands of organized crime today, and is outside the control of the Central Banks?

LaRouche: It's hard to say, because there is obviously no difference between organized crime and these kinds of things. [Laughter] For example, take the case of the so-called Mega group in New York. The Mega group is composed chiefly of the leadership of U.S. organized crime, including the Bronfman family, which owns Senator McCain, which owns Senator Lieberman. When you look at the way the United States is structured, absolute gangsterism, including drug money laundering, [is very important].

The United States said, "We are going to go after the Colombian terrorists." Well, they won't go after the Colombian terrorists. They won't. Why? Their money's involved! Why do you think Grasso went down to Colombia to meet with the FARC? Why do you think Soros does the things he does? Because the financial derivatives and related leveraging of drug money in the international market, is the major prop. That's the problem. There is no difference.

Moderator: It is said, that one can agree or disagree. But I believe that all of us agree that Mr. LaRouche is a man of courage, because to say these things, about organized crime, is unusual in Brazil; I don't know about in the United States. I know his ideas from his books, and people may disagree in many things, but people should reflect on it....

As he said: either we organize ourselves another boat, or we are going to have to fix the boat. I prefer to stay in the boat, and try to seek the best solution. And the best solution, evidently, will come not from what people wish, but from what people are able to achieve, when they make decisions.... And since all citizens are involved in these decisions, reflect upon Mr. LaRouche's words. Because one can analyze them, and there could be differences of analysis, but one should not ignore them.

Many thanks to all of you for your presence, and many thanks to Mr. LaRouche for the opportunity for a dialogue on what Brazil will face internationally.

schiller@schillerinstitute.org

The Schiller Institute

PO BOX 20244

Washington, DC 20041-0244

703-297-8368

Thank you for supporting the Schiller Institute. Your membership and contributions enable us to publish FIDELIO Magazine, and to sponsor concerts, conferences, and other activities which represent critical interventions into the policy making and cultural life of the nation and the world.

Contributions and memberships are not tax-deductible.

VISIT THESE OTHER PAGES:

Home | Search | About | Fidelio | Economy | Strategy | Justice | Conferences | Join

Highlights | Calendar | Music | Books | Concerts | Links | Education | Health

What's New | LaRouche | Spanish Pages | Poetry | Maps

Dialogue of Cultures

© Copyright Schiller Institute, Inc. 2002. All Rights Reserved.